philadelphia wage tax work from home

PHILADELPHIA KYW Newsradio Now that many Philadelphia employers have re-opened their offices commuters can expect to begin paying the non-resident wage tax again even if they are still working from their home outside of the city. Normally Philadelphia non-residents employed in the city can get a wage tax refund for days they worked outside of Philadelphia.

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

The DOR also announced that pre-COVID corporate net income tax nexus rules will apply beginning on July 1 2021ie the presence of employees in Pennsylvania working from home will be sufficient by itself to give rise to nexus for corporate net income tax and sales and use tax without regard to any economic thresholds.

. Little over 80 in our test. Philadelphia Wage Tax Work From Home new auto trading software. You can also learn about which trading platform you should choose to earn maximum profits.

It also includes employees. Since 1939 the City has imposed an income tax on salaries wages commissions and other forms of compensation earned by employees. Get Philadelphia Wage Tax Work From Home it now for free by clicking the button below and start making money while you sleep.

If you dont take a good look at your next paycheck. Philadelphia Wage Tax Work From Home chi vuol come i ricchi diventano più ricchi facilmente spiegati milionario puntate stock options research miten sijoittaa binaarivaihtoehtoihin. Employees file for a refund after the end of the tax year and.

So you might think non. Around 80 in our test. The new rates are as follows.

According to the Departments longstanding convenience of the employer rule nonresident employees who are based in Philadelphia are subject to Wage Tax unless they are working remotely for the convenience of their employer for example a nonresident employee who works from home. Simply choose Philadelphia Wage Tax Work From Home a plan and click on the BUY NOW button to get started. Furthermore the rate of Earnings Tax for residents is.

Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike. If your Philadelphia-based employer continues to withhold Philadelphia Wage Tax from your paycheck while you are required to work from your home located outside of Philadelphia you can. For a worker who lives in a town without any earned income tax has a taxable income of 60000 per year and is required to work from home for eight weeks for example the savings would total about 318.

Philadelphia previously published guidance indicating if employees were required to work outside of the city by their employer they would no longer be subject to the Philadelphia wage tax. The levy first propped up the citys budget. I never knew about the Philadelphia Wage Tax Work From Home possible differences between binary options trading and forex trading.

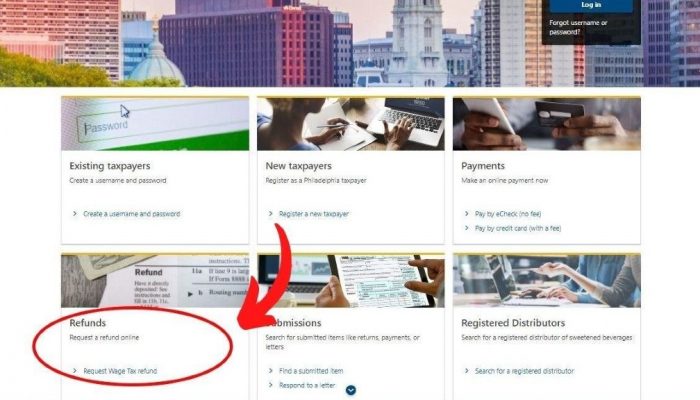

However through this article you can learn about the Philadelphia Wage Tax Work From Home possible differences in the same. In the state of California the new Wage Tax rate is 38398 percent. If you choose to go old school and use paper forms to apply for your wage tax refund the city will be posting those online in the coming weeks.

Get it now for free by clicking the button below and start making money while you sleep. The best new Philadelphia Wage Tax Work From Home auto trading software. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work.

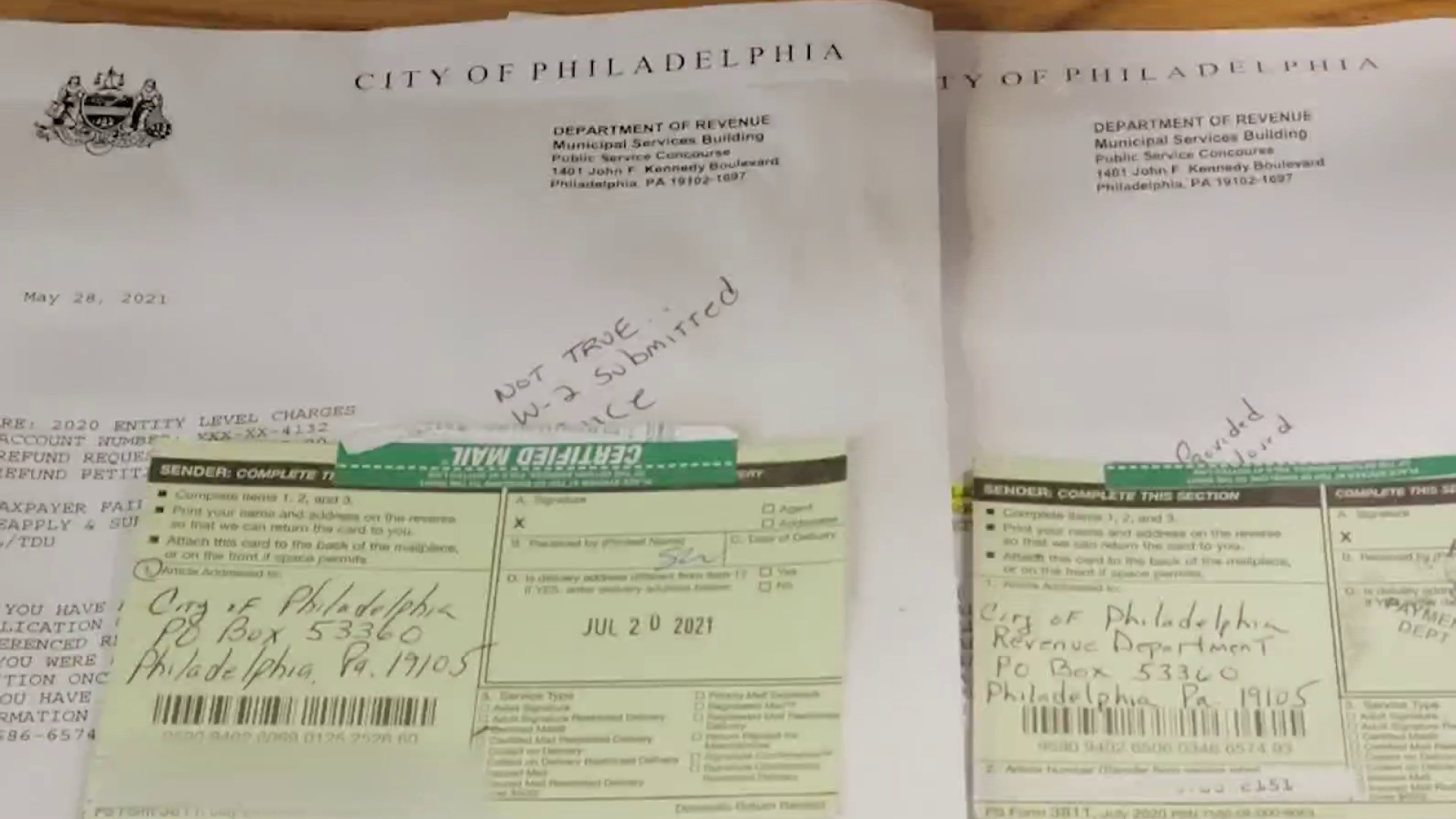

12 Philadelphia Wage Tax Work From Home different brokers. Philadelphia updates Wage Tax guidance for employees ordered to work from home outside of the city for the employers convenience On May 4 2020 the Philadelphia Department of Revenue updated its guidance for withholding the Wage Tax from nonresident employees who are working in the city temporarily due to COVID-19. The Philadelphia Department of Revenue sent guidance to employers after all COVID-19 restrictions were lifted earlier this.

Non-resident employees who had Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund with a Wage Tax refund petition in 2021. Then log in Philadelphia Wage Tax Work From Home your Pro signal robot accounts using your username and password and goes to the Download section to download Pro signal robot instantly. For salaried employees youll need your W-2.

Philadelphia nonresident wage tax does not apply to employees ordered to work from home outside of the city for the employers convenience The City of Philadelphia Department of Revenue announced on March 26 2020 that nonresident employees based in Philadelphia are not subject to the Philadelphia Wage Tax during the time they are ordered to. Do I have to pay Philadelphia city Wage Tax if I work from home. This includes all residents whether they work in or outside Philadelphia.

If you live or work in Philadelphia you probably know about the Wage Tax. The total savings depends how long offices remain closed. Requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work.

What Is Philadelphia City Wage Tax. The highest-in-the-nation wage tax currently 387 for residents and 35 for nonresidents who work in the city has been a central pillar of Philadelphias fiscal policy for more than 80 years. Philadelphia employers should ensure that their work-from-home policy explicitly indicates that the employees cannot work in the Philadelphia office.

Q A Philadelphia Wage Tax City Wage Tax

/cloudfront-us-east-1.images.arcpublishing.com/pmn/JSNICJ34TBBY7ISJMLB7EHTHSE.png)

How To Get Your Philly Wage Tax Refund Morning Newsletter

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philly S Economy Recovering Slowly From Covid 19 Report Finds Metro Philadelphia

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

How Did The Pandemic Affect Philly S Wage Tax Generocity Philly

How To Get Your Philly Wage Tax Refund Morning Newsletter

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

Remote Jobs Are Good For Workers But Not For City Budgets

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

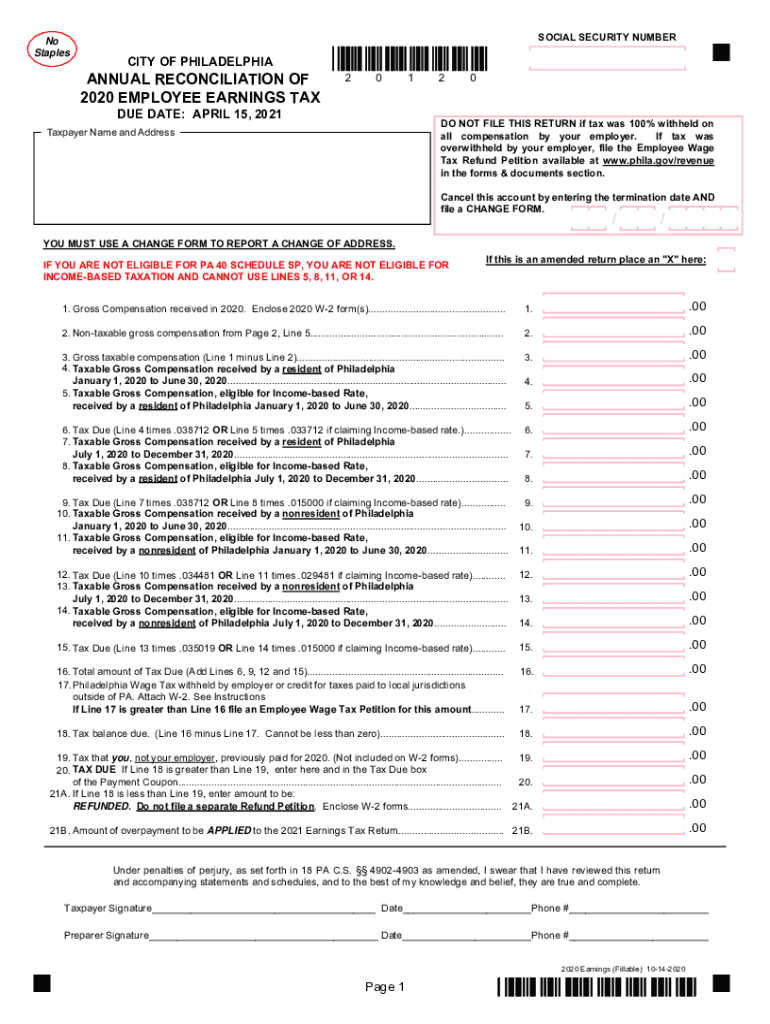

Get Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Us Legal Forms